So how does negative gearing all work?

This is a common question we see from our clients and inbound enquiries, there are lots of misconceptions so let’s clear them up. Negative gearing is a tax minimisation strategy used primarily for investment properties. (You can also use this strategy with shares, but that is another topic for another day).

The aim of negative gearing is to push your taxable income down as low as possible, this is done by totalling all the cost of property purchase as well as all associated holding costs and subtracting it from your taxable income.

These costs are (but not limited to)

- Any marketing costs to acquire tenants

- Any fees charged by your accountant for lodgement

- Interest on your investment loan

- Council rates, body corporate fees, land tax and strata fees

- Repairs, maintenance, pest control, cleaning and gardening

- Insurance on your rental property

- Depreciation on the building and some fixtures and fittings

Here is a quick video showing you how negative gearing works.

New apartments are a popular choice for investors looking to use negative gearing as a strategy, this is because of the depreciation available to claim in the first few years. Think of it like a car, most of the depreciation happens in the first few years, this is claimed and then you have a choice to make.

- Keep the property and pay it down so it generates an income for you OR

- Sell it (assuming you have had capital growth) and move onto another new apartment to restart the process

- Keep the property and look for a new acquisition to add to your portfolio

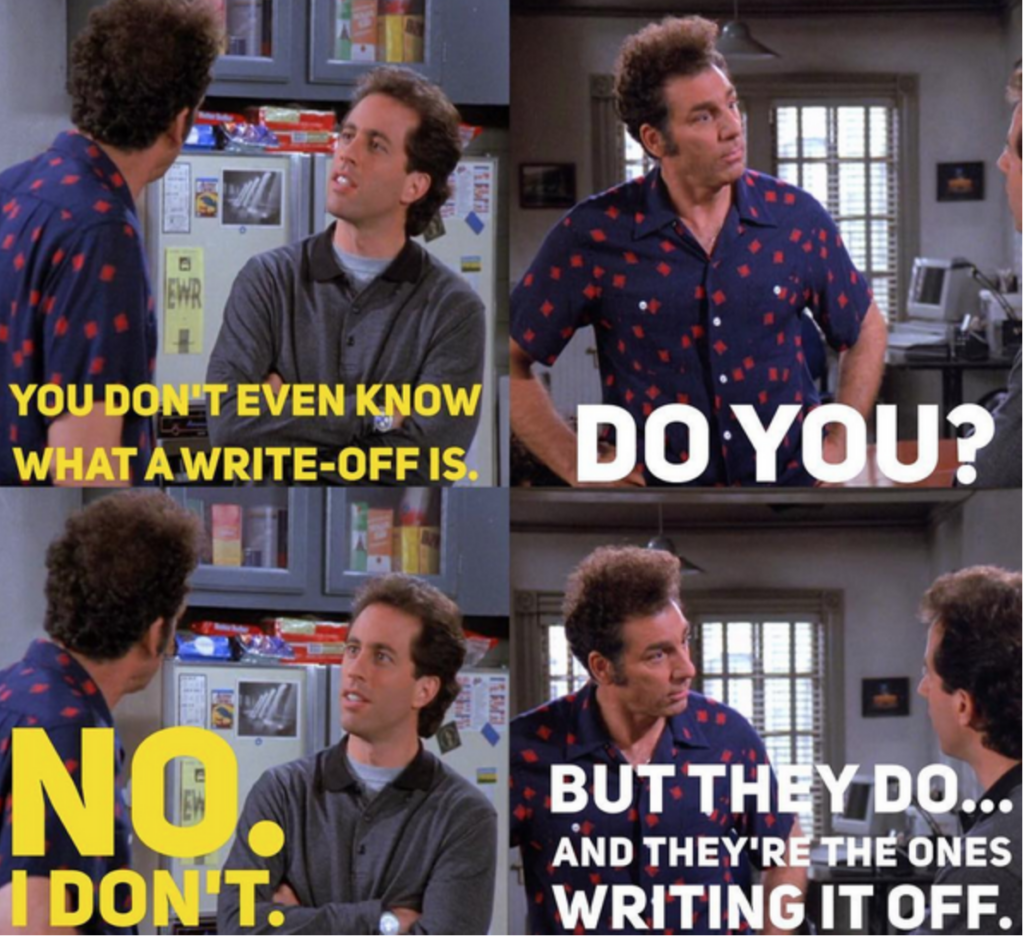

Think of negative gearing like running a business at a loss on purpose, in order to reduce your own taxes. And then using those savings to either pay down the loan or put it towards savings and/or a deposit on your next purchase.

Negative gearing is not for everyone so it is at this point that we recommend that you get in touch with your accountant for advice, if you do not have one, we are happy to put you in touch with some experts who can advise you on the correct individual structure to suit your needs.

Some interesting facts from the Federal Treasury department:

- Over 1.9 million people earned a rental income

- Around 1.3 million of these reported a net rental loss

- Nearly 70 per cent of people with negatively geared property had a taxable income of less than $80,000 per year

This all sounds great, What are the negatives? (Excuse the pun)

Easy – greed.

We always recommend that you have an investment strategy in place.

E.g Depending on your age, we always recommend that you aim to pay the property off so you have an income coming in along with the capital growth you are acquiring.

Do not over leverage:

A common enquiry we see is a person with a 65k salary with an existing investment property, looking to make their next purchase. The numbers generally do not stack up or they have to buy a cheaper property in an area that won’t see much growth. It is generally an ego play and not a purchase made with any basis of research or fundamentals required to make a good investment decision. Revisit this when you are earning more money.

The worst part is that you will be overleveraged, meaning that if the market swings in the area you purchased, you will be stuck waiting for the market to recover. Suburbs are individual property markets onto themselves, they may remain stagnant for reasons outside your control, such as lack of transport options or popularity amongst mid to high income earners.

Summary: Negative gearing is a great strategy, but the long term aim should be to have your properties be cashflow positive and/or paid off. You won’t get there by continually structuring your investment to lose money (e.g unless you plan on selling one to pay the debts off )

Speak to your accountant and reach out to us at startnow@sorenfinancial.com to find out about the best way forward for you.