Refinancing Your Home Loan

We recommend that borrowers keep an eye on the loan term to make sure that it remains the same term. Many borrowers are discovering that when they refinance, their mortgage term is automatically reset to 30 years, even if they’ve already paid down a portion of it. While a lower interest rate might seem like a win at first glance, the extended loan term can negate any potential savings and result in higher total interest payments.

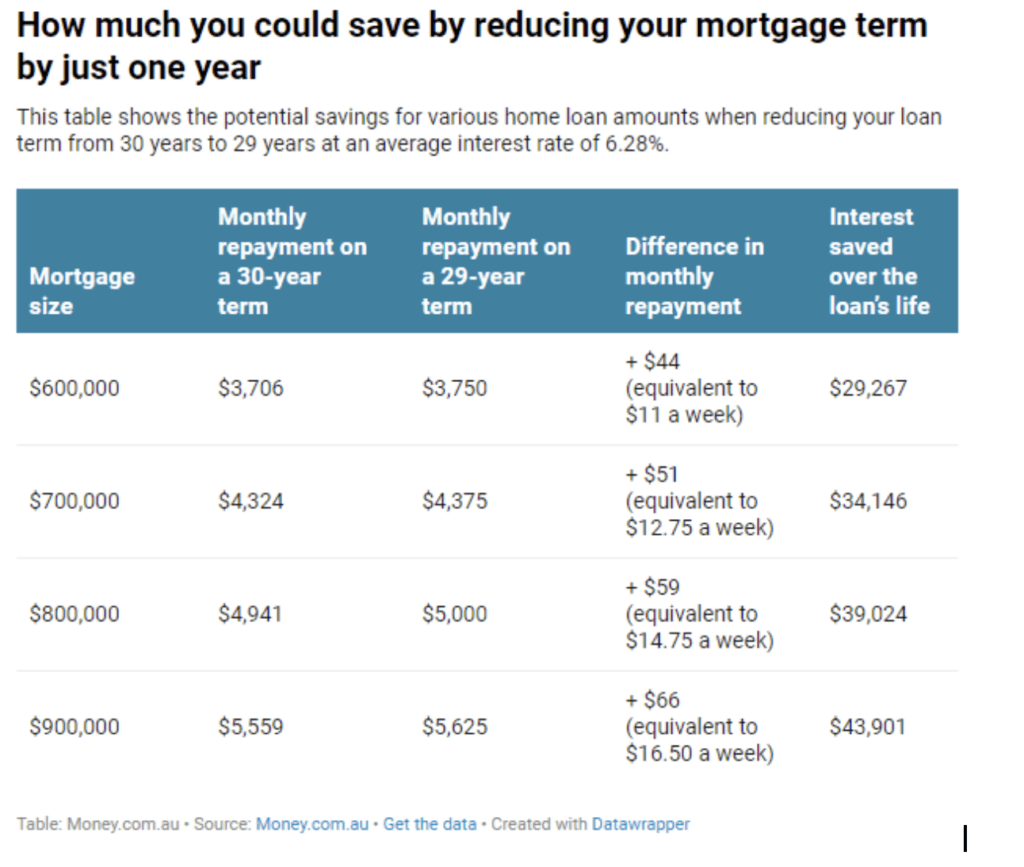

An analysis by Money.com.au highlights this issue clearly. Refinancing a 25-year $600,000 mortgage from the average interest rate of 6.37% to a slightly lower rate of 6.28% would reduce monthly payments by $297. However, if the loan term is reset to 30 years, the borrower could end up paying an additional $133,374 in interest over the life of the loan, this will have a significant impact on your future like what you end up with at retirement. This startling figure underscores the importance of paying attention to the term of your loan, not just the interest rate.

The current economic environment, characterised by record-high interest rates and a standard 3% serviceability buffer applied by banks, is forcing some borrowers into a longer loan term just to meet serviceability requirements. This means that even if you qualify for a lower interest rate, you could still be extending your debt timeline by years. However, if you can afford your current repayments and pass the serviceability check, it’s vital to request that your lender or mortgage broker keeps your existing loan term intact.

While extending your loan term might lower your monthly payments, it’s a costly move that could lead to paying significantly more in interest over time. As Mansour Soltani, a home loans expert from Soren Financial, points out, this is a trap that many borrowers fall into, often without realising the long-term financial consequences.

Take Brisbane homeowner Greg White, for example. Greg was shocked to discover that when he refinanced his mortgage, his loan term had been reset back to 30 years, which could have cost him an extra $68,000 in interest over the life of the loan. After diligently paying down his mortgage for three years, the last thing Greg wanted was to start over and potentially still be paying off his home as he approached retirement.

Greg and his wife faced a difficult decision. The lower monthly repayments offered by the extended loan term were tempting, especially given the financial pressures of rising interest rates and the recent addition of a new baby to their family. The prospect of extra cash flow each month seemed appealing in the short term. But after carefully considering the long-term implications, they realized that the additional interest costs outweighed the short-term benefits.

Determined to avoid paying more than necessary, Greg contacted his bank to discuss the issue. To his surprise, he was informed that a 30-year term is standard for home loans, even when refinancing. This revelation left him frustrated, as he felt that this critical detail hadn’t been clearly communicated during the refinancing process. Greg’s experience highlights a significant gap in the information provided to borrowers.

Ultimately, Greg and his wife decided to take matters into their own hands. They increased their regular payments to ensure they stayed on track to pay off their mortgage within their original timeline. Reflecting on the experience, Greg believes that banks should be more transparent about the implications of resetting a loan term during refinancing. He suspects that many borrowers might unknowingly opt for the default option and end up paying far more in interest than they intended.

The key takeaway from Greg’s story is clear: when refinancing, it’s essential to look beyond just the interest rate. Make sure you’re also paying attention to the term of your loan. By maintaining your current loan term, you can save yourself from paying thousands more in interest and ensure you’re not extending your debt unnecessarily. Always have an open conversation with your lender or mortgage broker about the implications of refinancing, and make sure your decision aligns with your long-term financial goals.

Feel free to contact us at startnow@sorenfinancial.com and we will show you the best way to refinance your existing loan and even better, how to shave time of your home loan term and save you hundreds of thousands.