As mortgage brokers, we see (on a daily basis) how pivotal of a role the Loan-to-Value Ratio (LVR) ratio plays in securing mortgages with lenders in the market. With every loan scenario/enquiry we receive, we contact multiple lenders to discuss your home loan scenario, the first question the lender rep will ask us is “What is the LVR?”

Understanding and managing your LVR is essential not just for loan approval but for obtaining the best interest rates available to you. Most people do not know their loan to value ratio assigned to their mortgage so anyone who deals with us will see us ask them.

- What is your loan amount?

- What is the value of your property?

- Is your property an owner occupier or an investment?

These are the exact same questions that the lender in question will want an accurate answer to.

What is a Loan-to-Value Percentage (LVR)?

Defining LVR

The LVR measures the relationship between the loan amount and the property’s valuation. For mortgage brokers it is a critical indicator used by lenders to assess the risk level of a loan. Essentially, it shows how much of a property is financed by the loan versus how much is covered by the borrower’s own funds.

What does 80% LVR Mean?

Let’s use this as an example to calculate your LVR. An 80% LVR loan is the most common type of loan, an 80% LVR loan product means that you are coming up with 20% and the bank is lending you the remaining 80%

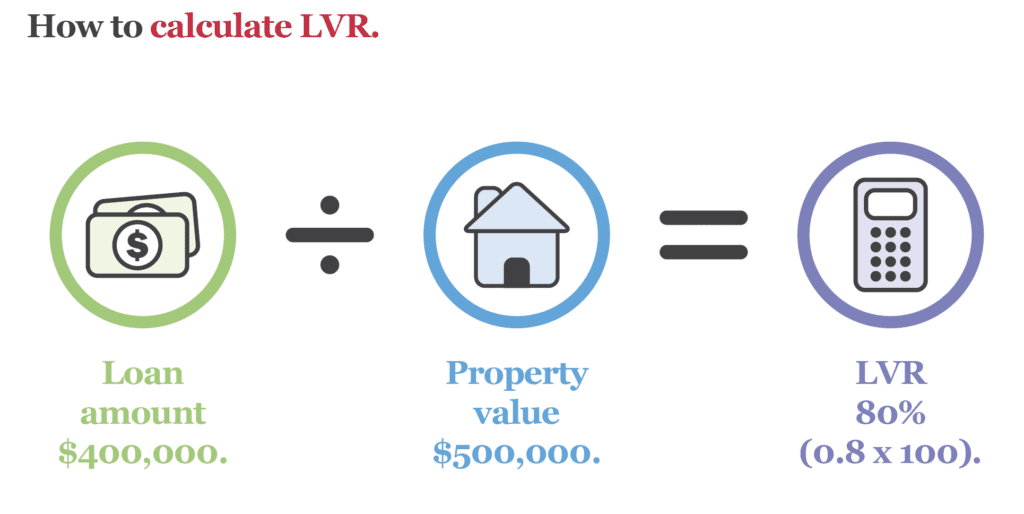

Calculating the LVR is straightforward: you divide the mortgage amount by the property’s value and then multiply by 100 to express it as a percentage. For instance, if a property is valued at $500,000 and the loan amount is $400,000, the LVR ratio is 80%.

Importance of the LVR for Mortgage Brokers

The Impact of the LVR on your Mortgage Approval

From our experience in dealing with over 45 lenders in the market, a lower LTV ratio improves the likelihood of mortgage approval. Lenders perceive a lower risk when the borrower has a significant equity stake in the property.

LVR Ratios and Interest Rates

Lenders price interest rates dependant on the LVR band, let me give you some examples:

60-70% LVR

71-80% LVR

81-90% LVR

Generally, the price difference is around 10 basis points between these bands. The aim if the game is to get your LVR down to 60% and below at some point. This is where you will be offered the best rate possible by the lenders you are dealing with.

Lender’s Mortgage Insurance (LMI)

We always recommend that you aim for a 20% deposit of 80% LVR product however this may not always be possible especially for first home buyers. For LVR ratios exceeding 80%, borrowers are typically required to purchase mortgage insurance. This protects the lender in case of default but represents an additional cost for the borrower.

How Mortgage Brokers Can Influence LVR Ratios

Advising on Property Value

For mortgage brokers, we can run upfront valuations on properties and give you a quote around what your funds required are to complete the property purchase at the price advertised. We can also shop the valuation around to multiple lenders as there can sometimes be a difference and this difference can be the difference between either a 10 basis point discount or avoiding lender’s mortgage insurance.

Your Home Loan Structure

We always sit down with clients post settlement to discuss how we can reduce your home loan term down from 30 years by around 8 years. Part of this is encouraging clients to increasing their repayments so we can jump LVR bands from e.g. 80% to 70%. This is done with an increase in repayments and property value.

Conclusion

For us mortgage brokers, I cannot overstate the importance of understanding and effectively managing LVR ratios over your loan period. Your LVR is crucial for securing lower interest rates and favourable loan terms for clients. By optimising LVR ratios, we can help reduce your overall interest amount paid back to the lender and increase the chances of loan approval. As always feel free to reach out to us at startnow@sorenfinancial.com with any questions or even tips from our team on how to lower your LVR