Introduction:

Taking out a second mortgage can be a strategic financial move, but it’s not without its complexities and risks. Whether you need extra funds for home improvements, debt consolidation, or even purchasing an investment property, understanding the ins and outs of second mortgages is crucial. In this comprehensive guide, we’ll explore what a second mortgage is, how it works, and whether it might be the right option for you.

What is a Second Mortgage?

A second mortgage allows you to borrow against the equity in your home, creating a second loan on top of your existing mortgage. Equity is the difference between your property’s market value and the remaining balance on your first mortgage. The second mortgage is a separate loan, meaning it doesn’t alter the terms of your original mortgage but does add an additional lien on your property.

Example Calculation of How Much You Could Borrow for a Second Mortgage

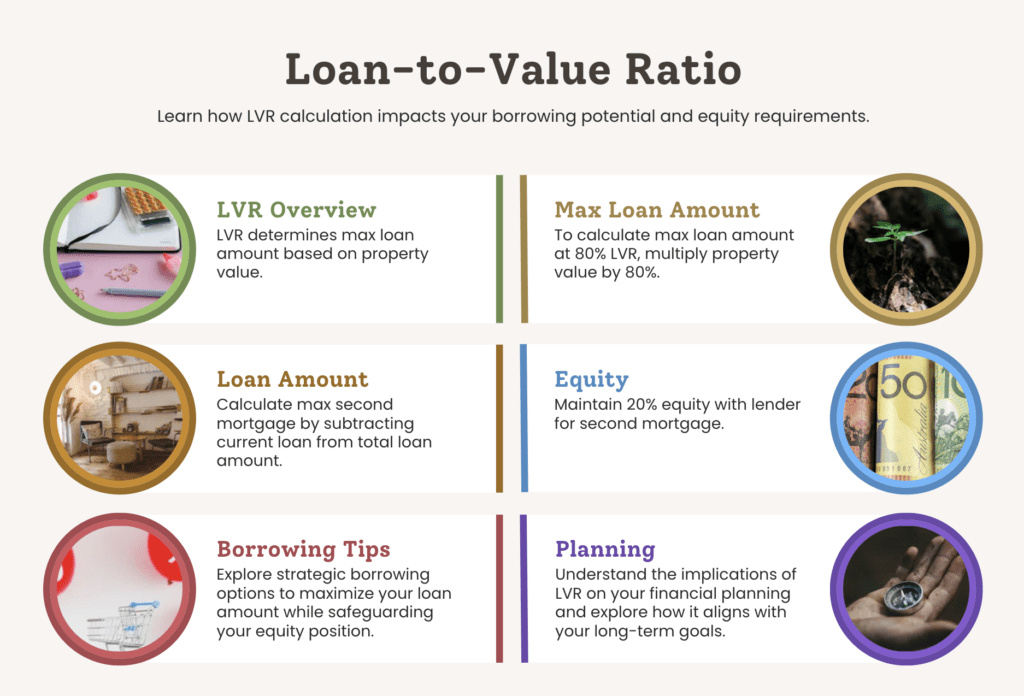

To determine how much you could borrow with a second mortgage, most lenders require that you maintain 20% equity in your home. Here’s a simple example to illustrate this:

Suppose your home is valued at $800,000, and your current mortgage balance is $400,000. The maximum loan-to-value ratio (LVR) allowed by the lender is 80%. Here’s how the calculation works:

Calculate the total value you can borrow up to 80% LVR:

Maximum total loan amount = Property value × 80%

Maximum total loan amount = $800,000 × 0.80

Maximum total loan amount = $640,000

Calculate the current loan balance:

Current loan balance = $400,000

Calculate the maximum second mortgage loan amount:

Maximum second mortgage loan amount = $640,000 − $400,000

Maximum second mortgage loan amount = $240,000

Therefore, you could borrow up to $240,000 with a second mortgage while maintaining the lender’s required 20% equity.

When Can You Use a Second Mortgage?

Second mortgages can be used in various scenarios, including:

Acting as a Guarantor

You might need a second mortgage if you’re acting as a guarantor for a family member’s mortgage. This can help them reduce their loan-to-value ratio (LVR) and potentially avoid lender’s mortgage insurance (LMI).

Alternative to Refinancing

If refinancing your current loan isn’t financially viable due to high break costs or favorable fixed rates, a second mortgage can be an alternative to access needed funds.

Buying an Investment Property

Leveraging your home equity to purchase an investment property can be a smart move, but it’s essential to weigh the risks, such as the potential for negative equity.

Freeing Up Cash Flow

You can use a second mortgage to consolidate debt, finance home renovations, or cover other significant expenses. This might be more cost-effective than using high-interest credit cards or personal loans.

How to Apply for a Second Mortgage

Applying for a second mortgage can be done through:

Direct Application with Lenders

Some lenders specialize in second mortgages. You’ll need to provide income verification, property documents, and possibly face higher interest rates and fees due to the increased risk for the lender.

Using a Mortgage Broker

Mortgage brokers can simplify the process by connecting you with lenders that offer second mortgages. They can help you navigate the application process and find the best terms.

Second Mortgage vs. Cash-Out Refinance: What’s the Difference?

Second Mortgage

A second mortgage is an additional loan on top of your existing mortgage. You’ll have two separate loans with different terms and interest rates. Monthly payments are made to both loans.

Cash-Out Refinance

This involves refinancing your existing mortgage for a higher amount than you owe and taking the difference in cash. It consolidates your debt into a single loan with one monthly payment.

Pros and Cons:

Second Mortgage:

Pros: Doesn’t change the terms of your first mortgage, allows leveraging equity without refinancing.

Cons: Higher interest rates, two monthly payments, stricter eligibility criteria.

Cash-Out Refinance:

Pros: Single monthly payment, potentially lower interest rates.

Cons: Changes the terms of your first mortgage, possible higher overall loan balance.

Is a Cash-Out Refinance a Better Option Than a Second Mortgage?

In many cases, a cash-out refinance might be more straightforward and cost-effective than a second mortgage. It avoids the need for permission from your existing lender and simplifies your payment structure. However, if you’re locked into favorable terms on your first mortgage, a second mortgage might be a better choice.

Pros & Cons of a Second Mortgage

Pros:

Leverage home equity without selling your property.

Keep favorable terms of your first mortgage intact.

Potentially lower interest rates than personal loans or credit cards.

Cons:

Higher interest rates compared to first mortgages.

Increased debt and two separate payments.

Stricter eligibility and higher fees.

Features of Second Mortgages

Interest Rates: Typically higher than first mortgages due to increased risk.

Loan-to-Value Ratio (LVR): Usually lower, with combined LVR not exceeding 80%.

Repayment Terms: Generally shorter, between 10-20 years.

Eligibility Requirements: Stricter, with fewer lenders offering these loans.

How Much Could You Borrow for a Second Mortgage?

Lenders generally require maintaining 20% equity in your home. Using the example provided, you could borrow up to $240,000 if your home is valued at $800,000 and your current mortgage balance is $400,000.

Scenarios Where Second Mortgages Make Sense

Personal Financial Scenarios:

Debt consolidation

Home renovations

Paying off high-interest debts

Investment Scenarios:

Purchasing an investment property

Funding a second home

How to Build Equity in Your Property

Paying extra towards your mortgage reduces the principal faster, building equity.

Increasing Property Value:

Home improvements and renovations can increase your property’s market value.

Market Conditions:

Property values naturally rise over time, increasing your equity.

Risks Involved with Second Mortgages

Negative Equity:

If property values fall, you could owe more than your property is worth.

Higher Interest Rates:

Second mortgages typically come with higher rates due to increased risk.

Stricter Eligibility Criteria:

Fewer lenders offer second mortgages, and those that do have more stringent requirements.

FAQs about Second Mortgages

Who’s eligible for a second mortgage loan?

Requirements vary by lender but generally include Australian citizenship or permanent residency, being over 18, meeting minimum income requirements, having sufficient home equity, and a good credit score.

How do I build equity in my property? By making additional mortgage repayments, increasing your property’s value through renovations, or benefiting from market conditions that increase property values.

Can I get a second mortgage if I have bad credit?

It may be challenging, but specialist lenders offer bad credit home loans. Your income, equity, and possibly a guarantor will influence your eligibility.

How does a second mortgage affect my credit score?

Applying for a second mortgage will result in a credit inquiry, which can temporarily lower your credit score. However, timely repayments can positively impact your score over time.

What documents are needed to apply for a second mortgage?

Proof of income, living expenses, assets and liabilities, current home loan statements, and a copy of your property title.

Conclusion:

A second mortgage can be a useful financial tool for leveraging your home equity without altering the terms of your original mortgage. However, it comes with higher interest rates, stricter eligibility requirements, and the need for careful financial planning. By understanding the pros and cons, and comparing it to alternatives like cash-out refinancing, you can make an informed decision that best suits your financial goals.