The market has convinced us that the interest rate instead of your home loan structure is the most important part of your home loan and this is false. The home loan structure is actually way more important and in this blog post, we explore why and how the structure of your home loan can have a significant knock on other parts of your life, e.g your retirement. Navigating the intricacies of home loans can be daunting, but with the right knowledge, you can make informed decisions that lead to financial freedom faster than you’d expect.

Repayment Frequency Explained

Your repayment frequency

The default repayment frequency for most loans is monthly however did you know that switching to fortnightly can cut nearly 2 years off your home loan? Committing monthly means twelve payments annually. It’s systematic, fitting seamlessly with most salary structures for simpler budgeting.

Fortnightly Repayments

Choosing fortnightly divides your monthly commitment, resulting in 26 payments yearly, potentially aiding in quicker loan payoff. Imagine reading half a book chapter every two weeks instead of a full one monthly.

Weekly Repayments

Weekly repayments require consistent contributions and this option may not work for everyone, especially if you are paid monthly. It also does not make a massive difference to your overall interest paid over the life of your loan like moving from monthly to fortnightly does.

Shaving Years Off Your Home Loan

The Power of Extra Repayments

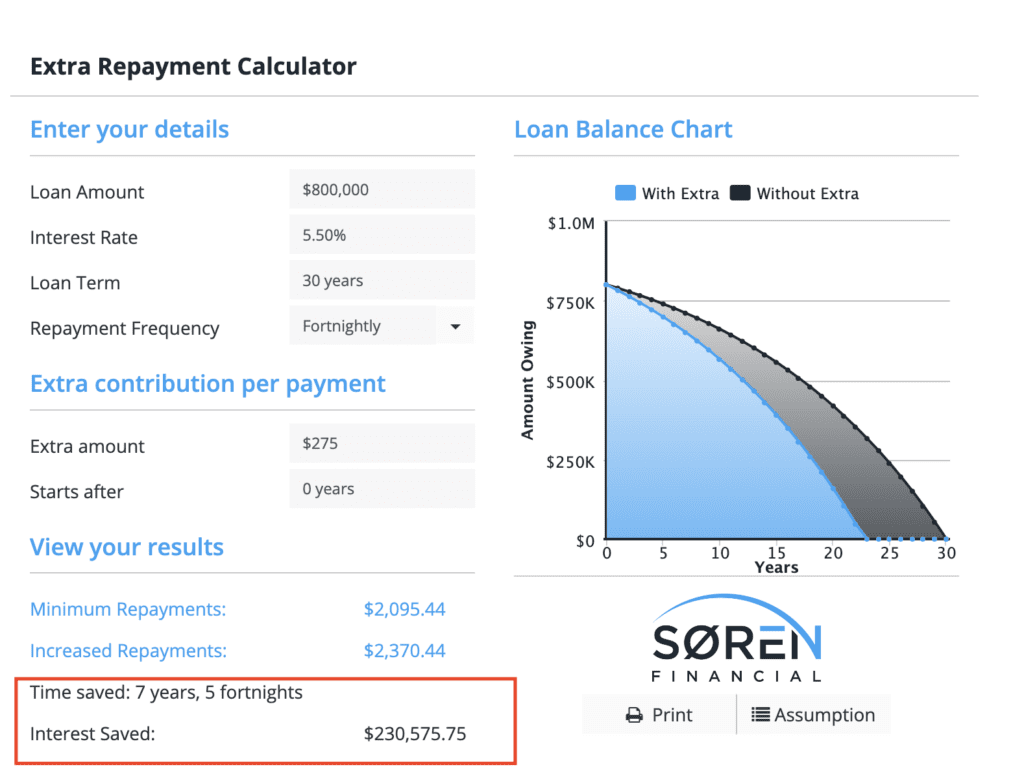

Throwing extra cash occasionally can reduce loan tenure. Consider these as bonus miles on a journey, hastening your destination arrival. Use our calculators so you can see the affects on your home loan and see for yourself. If we use an example in the image below, this shows a typical $800k home loan with a 5.5% interest rate. You can see that if you increase your repayments by 10% and move to fortnightly, you can shave off 7 years off your home loan as well as 230k in interest over the life of the loan.

The Impact of Increasing Your Repayments

A slight repayment increase will have exponential long-term effects on things such as your retirement. As we have shown in this example loan scenario, you are saving 230k in interest. Now, if this extra 230k is now being saved and placed into an interest-bearing savings account, or even if you made extra super contributions, this would have compounding effects and you would be much better off than you would be under a traditional home loan structure.

Utilising Offset and Redraw Accounts

An offset account is like a financial buddy, reducing the loan interest you owe. Conversely, a redraw facility is a safety net, granting access to extra repayments. Use these types of accounts like you would a savings account, have your pay go into this account and pay your outgoings from this account. This habit on average can shave just over a year off your home loan term.

Benefits of Effective Loan Management

Financial Stability

Effective loan management ensures financial stability, warding off unforeseen burdens. It’s like correctly setting boat sails for smooth sailing.

Early Home Ownership

Strategic repayments can lead to early home ownership, a many-harbored dream which then allows you to focus on other endeavours such as investing in property/shares. The pride and freedom of owning your home well before retirement is a goal that all home owners should aim for but more importantly should plan for.

Seeking Expert Advice

The Role of Mortgage Brokers in a Home Loan Structure

Navigating the world of home loans can be complex. This is where mortgage brokers like Soren Financial come in. They offer tailored advice, helping you find the best loan suited for your needs. Unsure where to start? A quick Google search for “mortgage broker near me” can set you on the right path.

Why Choose Soren Financial?

Rated No. 1 on OurTop10, Soren Financial offers unparalleled expertise in the mortgage domain. Their team ensures you get the best deal, aiding in faster home loan payoff. It’s like having a financial GPS, guiding you through the maze of mortgage options.

Real-life Examples

Jane’s Smart Repayment Strategy

Jane always poured her bonuses into extra repayments. Her disciplined approach to maintaining a healthy offset account balance significantly reduced her loan tenure. She has her salary paid directly into her offset and she has set up her fixed expenses to be paid out of her offset since Jane understands that interest on her home loan is calculated daily. This plan will save her tens of thousands in interest.

Tom’s Decision to Increase Repayments

After securing a higher-paying job, Tom smartly increased his monthly repayments by 10% and changed his repayments from monthly to fortnightly. This foresight allowed him both a better lifestyle, a more disciplined approach to his finances and a road to an earlier home loan payoff. Tom realises that the money he will save in the hundreds of thousands in interest and, more importantly, that he will have his home loan on his owner-occupier paid off well before retirement. His strategy to pay off his owner-occupier loan as quickly as possible is imperative to him, as there is no tax benefit to his owner-occupier loan so he wants it paid off asap.

Conclusion

Unlocking Financial Freedom

The path to homeownership, devoid of lingering debt, is worth every strategic decision. Understanding and optimizing home loan structures, leveraging tools like offset and redraw accounts, and seeking expert advice can make this dream a reality faster.

FAQs

- What’s the difference between offset and redraw accounts?

- An offset account reduces loan interest based on its balance, while a redraw lets you access extra repayments.

- Are both these facilities available with all loans?

- Most modern home loans offer these, but it’s essential to verify with your lender or Google mortgage broker near me or even better, speak to us!

- Are there redraw facility charges?

- Some loans might have fees; always verify before deciding.

- How frequently can I redraw?

- It depends on the lender and loan terms.

- Is a higher offset balance always beneficial?

- Generally, yes. A higher balance means reduced loan interest however also paying down your home loan balance is recommended.

. Mansour have been amazing with his attention to getting things paid off quickly and very helpful with the process the loan process.

. Mansour have been amazing with his attention to getting things paid off quickly and very helpful with the process the loan process.