With rising interest rates, is now the time to I fix my loan?

We are currently being asked this question 6-7 times a day from clients from all walks of life, and the answer we give is unique to each personal situation. There are many variables (excuse the pun), so let’s cover the main ones off:

How long should I fix for?

Well, if you are a “set and forget” kind of person who doesn’t want to think about rates for a while, I would recommend fixing for 2-3 years. Also the cost of fixing for 4/5 years is quite high. The main reason people want to fix for that period of time is peace of mind and also controlling your fixed costs for a term.

I get that however it needs to make financial sense as well, when you fix the banks have already added a margin into the rate so you need to run the numbers to make sure you are not paying too much for the privilege. Depending on the lender and the rates being offered at the moment, we recommend looking at 2/3 year fixed rates as a start. Anything above this and you are paying a hefty margin above the existing variable.

Fixed VS Variable Argument

There are people who sit on either side of this argument, however if you look at this through the lens of “the bank is 5 steps ahead of you and will always win”, then the aim of the game is to reduce how much they win by and this is where your broker can help :).

Let me give you an example: at the moment variable rates are back to being cheaper than fixed, the lenders seem to be increasing these rates monthly and weekly in some instances it seems like there is a race to 3.5% for fixed rates.

So, if you were to stay variable (Adelaide Bank has a 1.99% Variable rate), you will get stung later on in the year when the RBA starts to raise rates, you might then think about fixing but the rates will already be past 3% by that point.

So, should I fix for 5 years to counter rising interest rates?

The banks have already priced in your potential exuberance into the rates available at 4–5 year mark so there will be no real financial gain spending the next few years paying 3.5% to 4% starting now.

Thanks Captain Obvious, so what are you getting at?

There are other options available to you, other than fixing your rates. Some examples are:

- Splitting your loan. This is a great way to hedge your bets and give you peace of mind. Variable rates are lower than fixed so if you work out your average across the two, you could be getting a great deal by structuring your loan this way. A great example of this is Adelaide Bank’s offering of 1.99% Variable and 2.89% fixed for two years. In aggregate you are receiving 2.44% and savings thousands per year (depending on your loan size).

- Use an offset account: Connect this account to the variable component of your loan. Have your salary placed into your offset and use this account to pay bills etc.

- Make extra repayments: take a look at the below graphs and see the difference for yourself

- Shameless Plug: Have a broker review your loans for you, get in touch at startnow@sorenfinancial.com

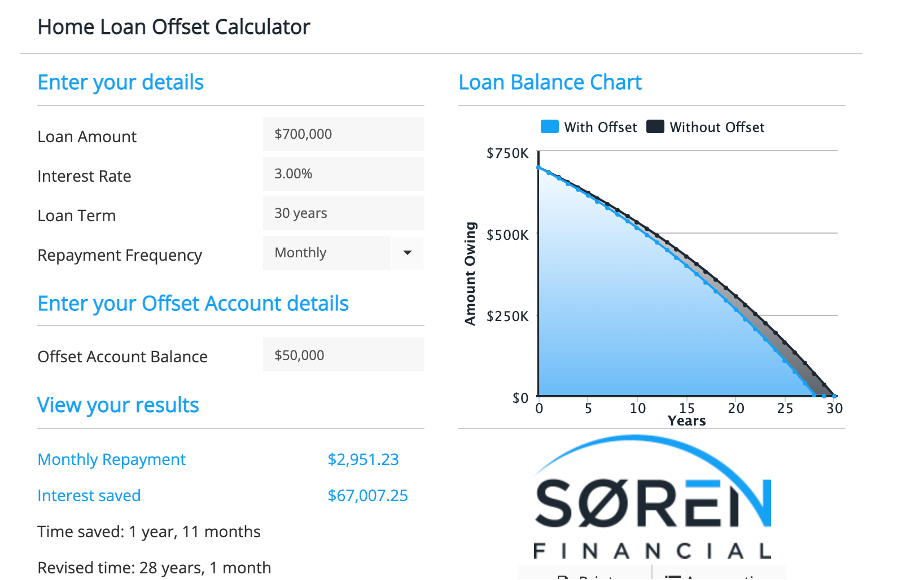

Take a look at these graphs which you can find on our website and see the years you save of you place 50k into an offset, you have nearly wiped 2 years off your loan

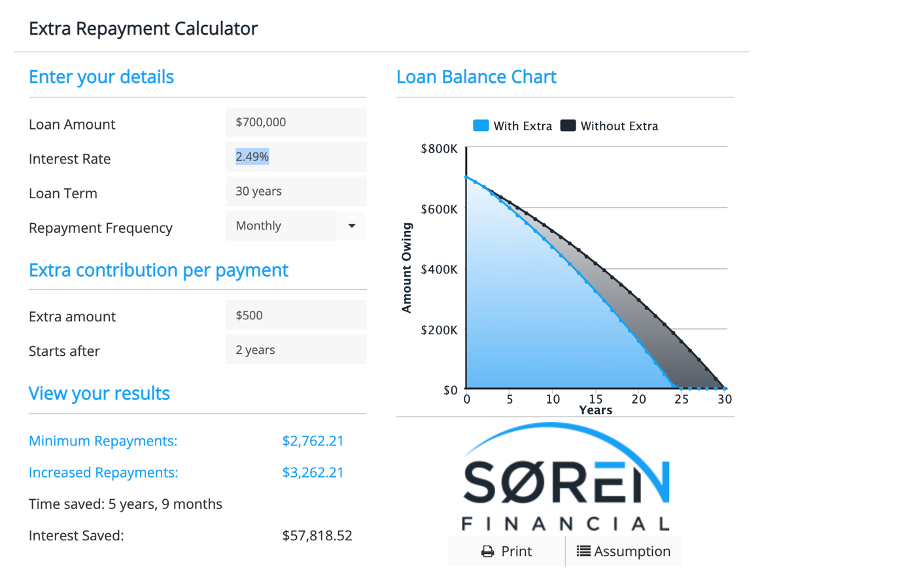

If you can add another $500 per month to your loan as an extra repayment, look at what happens, you save 5 years and 9 months or nearly 58k

Moral of the story is that there are other ways to counter rising rates, go to our calculator section and see for yourself or even better get in touch and we will show you how you should be structuring your loan and preparing for the future. Contact us at startnow@sorenfinancial.com to learn more.